A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. This is the main area where businesses record any and all cash-related information. All cash transactions during an accounting period are made in chronological order and recorded in it.

All items on the credit side of the cash book are posted to the debit of respective accounts in the ledger. The cash book is used to record all cash receipts and payments. It contains debits and credits which are double-entry Bookkeeping entries.

Since all cash receipts and payments are recorded in cash books, it is easier to access information. When a cash book is maintained separately, there is no reason to keep a cash account in the ledger. For all purposes, a cash book is treated like a cash account (a part of the ledger). Cash books can function as a journal or book of prime entry since all transactions are recorded as and when they occur. It also acts as part of the ledger because it has cash and bank accounts.

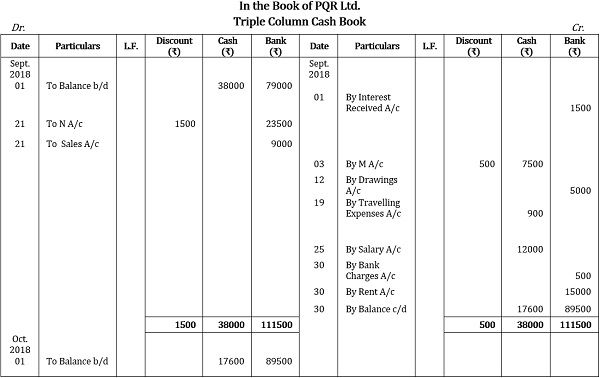

This type of cash book is used by businesses who want to track each individual transaction in the most detail possible. Triple column cash books will show all of the details from single and double column cash books plus some additional details. These would include things like purchase discounts, cash sales information and more. For double-column cash books, an additional column is reserved for discounts.

When money is received, it is recorded in the cash book as a debit. However, there are different types of cash books which can be more complicated. From the following particulars write up the cash book of Rashid Khwaja Trading Co. for the month of October, 2016.

Therefore, cash receipts and transactions are documented in one column, while the second column lists discounts received and provided. At the end of an accounting period, both columns are balanced, and closing balances are properly transferred. The procedure of recording transactions in a triple/three-column cash book is similar to that of a double-column cash book. Contra entries are not posted because the double entry accounting for these transactions is completed within the cash book. All items on the debit side of the cash book are posted to the credit of respective accounts in the ledger.

As the name implies, there are two columns for this type of cash book. It allows users to keep more detailed notes about their transactions. The main difference between a cash book and a journal is that a cash book tracks payments and receipts.

The following transactions were performed by the company during the month of June 2018. The procedure of posting entries from a cash book to ledger accounts has been explained in single column cash book article. The same procedure is followed for posting entries from double as well as triple column cash book to ledger accounts. Although single and double column cash books are alternatives to a cash account, the three column cash book serves the purpose of cash as well as a bank account. A cash book is a subsidiary book that includes both cash and bank transactions, and it is a journal and a ledger. Some companies utilize cash books instead of cash receipts journals and cash payments journals.

A cash book is an important tool for businesses to help track their finances. They allow businesses to keep track of payments and receipts in a detailed way. This can be used to make important decisions about the future of the business. how to void a check Additionally, cash books can be used to create financial statements. These provide a detailed overview of the business’s financial health. Companies need to keep track of their finances using a cash book for these reasons.

It records all the cash receipts on the debit side and all cash payments on the credit side. However, cash books never show a credit balance, only a debit balance. While there are multiple advantages to using a cash book, disadvantages exist too. A cash book is set up as a subsidiary to the general ledger in which all cash transactions made during an accounting period are recorded in chronological order.

21 de junio de 2023

Publicado en: Bookkeeping